Tax Season Scams Are Starting Early. Here’s the One That Hits Small Businesses First

Tax season has always attracted cybercriminals. But in 2026, tax season scams are starting earlier than ever, and small businesses across North Carolina are finding themselves in the direct line of fire.

From Raleigh and Durham to Cary, Chapel Hill, and Greensboro, business owners are juggling payroll, compliance deadlines, and employee documentation — all while cybercriminals quietly launch sophisticated tax season phishing attacks designed to exploit urgency and trust.

And among all the evolving threats, one stands out as the most damaging:

The W-2 phishing scam targeting small businesses.

If you own or manage a business in North Carolina, understanding how this scam works — and how to prevent it — could mean the difference between smooth operations and a devastating data breach.

Let’s break down what’s happening, why small businesses are especially vulnerable, and what you can do immediately to protect your organization.

Why Tax Season Scams Are Starting Earlier in 2026

Historically, most tax season fraud targeting small businesses peaked in late January or February. Today, however, cybercriminals begin reconnaissance months in advance.

Why?

Because businesses now operate in a digital-first environment:

- Cloud payroll systems

- Remote HR staff

- Email-based documentation

- Electronic W-2 distribution

The earlier scammers strike, the more likely they are to catch teams before internal verification processes are tightened.

In 2026, security analysts are already issuing a tax scam alert: attackers are sending phishing emails weeks before W-2 distribution deadlines, hoping to intercept payroll data before organizations are fully alert.

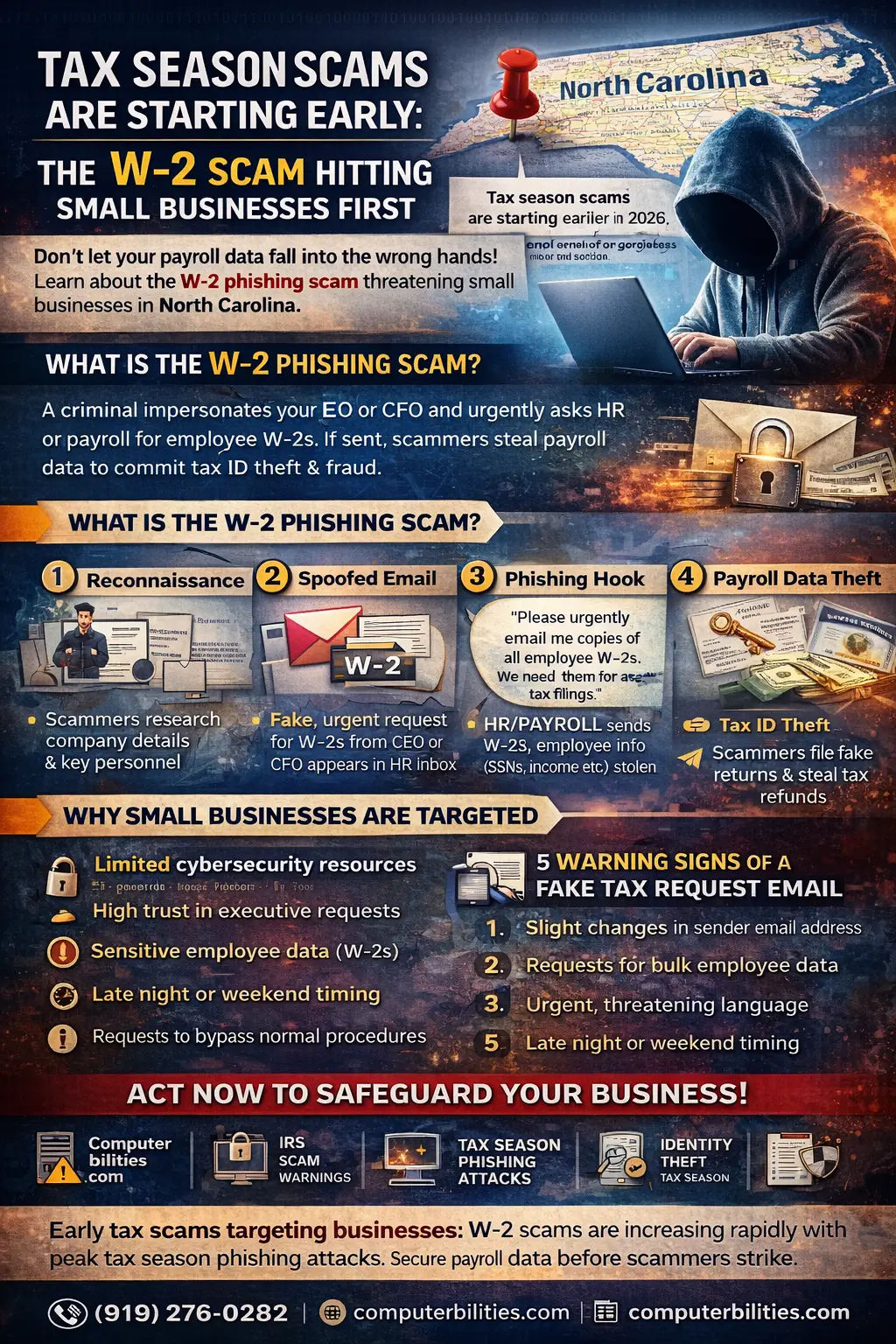

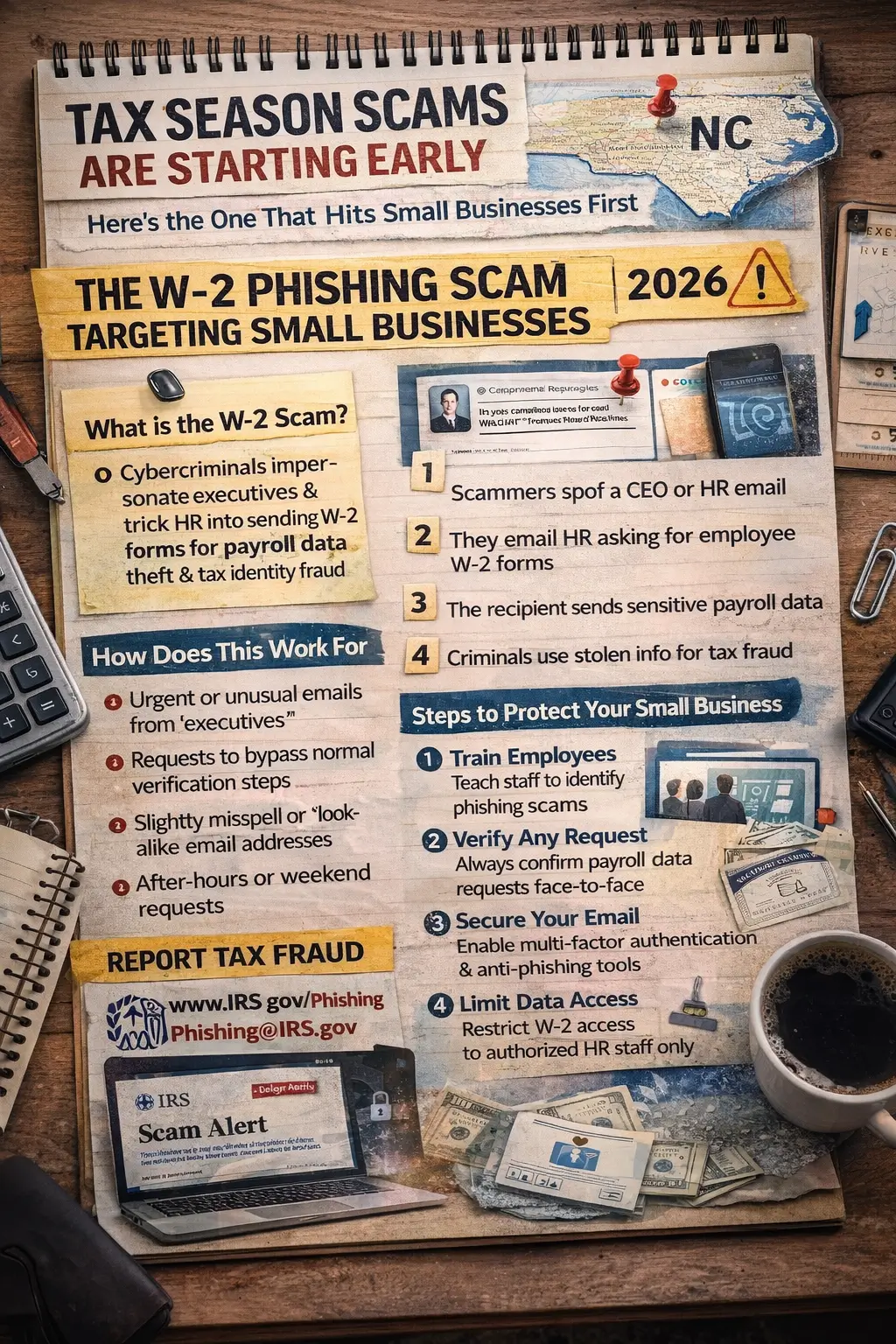

What Is the W-2 Scam Targeting Small Businesses in 2026?

If you’ve ever received an urgent email from a “CEO” asking for sensitive documents, you’ve seen the foundation of this attack.

The W-2 scam small businesses face is a form of business email compromise (BEC). It works like this:

- A cybercriminal spoofs or compromises an executive’s email.

- They send an urgent request to HR or payroll.

- The email asks for copies of employee W-2 forms or payroll summaries.

- The unsuspecting employee sends sensitive tax information.

- Criminals use the data for tax identity theft or sell it on the dark web.

It’s deceptively simple — and alarmingly effective.

Unlike traditional malware attacks, this scam doesn’t rely on hacking into systems. It relies on psychology.

Why Small Businesses in North Carolina Are Prime Targets

Large corporations have dedicated cybersecurity teams. Many small businesses do not.

In North Carolina, the economy is powered by small and mid-sized companies — law firms, healthcare practices, construction firms, retail stores, technology startups, and professional services companies.

These organizations often:

- Have limited cybersecurity staff

- Depend on a single HR or payroll manager

- Lack formal verification protocols

- Use email as the primary internal communication tool

This makes them particularly vulnerable to early tax scams targeting businesses.

Attackers know that smaller teams are more likely to:

- Trust executive requests

- Act quickly without verification

- Have fewer layered security controls

And once payroll data is exposed, the impact spreads beyond the company — affecting employees, reputations, and finances.

How Does a Tax Season Scam Work for Small Businesses?

Understanding the mechanics helps you prevent it.

Here’s how a typical W-2 phishing scam unfolds:

Step 1: Reconnaissance

Scammers research company websites, LinkedIn profiles, and press releases. They identify:

- Company executives

- HR managers

- Payroll staff

Step 2: Email Spoofing

Using email spoofing techniques, they create a near-identical email address that appears to belong to the CEO or CFO.

Example:

- Real email: ceo@companyname.com

- Fake email: ceo@company-name.com

One subtle dash can cost thousands of dollars in fraud.

Step 3: Urgent Request

The email often says:

“I need all employee W-2 forms immediately for tax filing. Please send ASAP.”

The tone is urgent and authoritative.

Step 4: Data Exfiltration

Once sent, employee Social Security numbers, addresses, wage data, and tax withholdings are exposed.

Step 5: Tax Identity Theft

Criminals file fraudulent tax returns using stolen data before legitimate returns are processed.

This is why tax season fraud statistics show spikes in identity theft during January through March.

Red Flags: How to Identify Phishing During Tax Season

Knowing the warning signs is your first defense.

Here are common indicators of fake tax request emails:

- Unexpected request for bulk employee data

- Urgent or threatening tone

- Slightly altered email domains

- Poor grammar or formatting

- Unusual timing (late night or weekend emails)

- Requests to bypass normal procedures

If an executive rarely emails HR directly, that alone should raise suspicion.

Teaching your staff to detect W-2 phishing emails is critical.

The Hidden Cost of Payroll Data Scams

Many businesses underestimate the damage of a successful payroll data scam.

Beyond financial losses, consequences include:

- Employee Trust Erosion

Employees expect their tax information to be secure. A breach can permanently damage workplace trust.

- Regulatory Scrutiny

North Carolina businesses may face compliance investigations and reporting obligations.

- IRS Reporting Requirements

Victims must:

- Report tax fraud to the IRS

- Notify affected employees

- Potentially provide identity protection services

- Reputation Damage

In tight-knit communities like Raleigh or Chapel Hill, reputation spreads quickly.

IRS Impersonation Scams Are Also Rising

The W-2 scam isn’t the only concern.

Cybercriminals are also deploying IRS impersonation scams, claiming:

- Immediate tax payment is required

- A warrant will be issued

- Business licenses will be suspended

These scams often combine email and phone calls to create credibility.

The IRS has repeatedly issued scam warnings stating:

- They do not initiate contact via threatening email.

- They do not demand immediate payment without written notice.

Understanding official communication channels is part of effective tax scam prevention for small business.

How to Prevent Tax Scams: A Practical Framework for NC Businesses

Effective small business cybersecurity during tax season requires a layered approach.

- Implement Multi-Factor Authentication (MFA)

Require MFA for:

- Payroll systems

- HR portals

- Email accounts

- Establish Verification Protocols

Create a rule:

No payroll data is sent without verbal confirmation.

Even if the CEO requests it.

- Conduct Phishing Simulations

Training employees to spot phishing reduces risk dramatically.

- Secure Email Systems

Invest in:

- Email spoofing prevention for business

- Advanced spam filtering

- DMARC and SPF configurations

- Limit Access to Sensitive Data

Only authorized staff should access W-2 forms.

- Backup Critical Systems

Ransomware sometimes accompanies cybersecurity tax scams.

Steps to Protect HR from W-2 Phishing Emails

HR departments are ground zero for this attack.

Provide them with:

- Clear reporting procedures

- A “pause and verify” checklist

- Direct executive phone contacts

- Documented response protocol

HR teams should never feel pressured to act without confirmation.

Best Practices to Avoid Payroll Tax Scams in 2026

Here’s a concise checklist for North Carolina businesses:

✔ Conduct annual cybersecurity audits

✔ Update incident response plans

✔ Monitor IRS scam warnings

✔ Train employees quarterly

✔ Require dual approval for tax data requests

✔ Encrypt sensitive documents

✔ Restrict third-party vendor access

Proactive prevention costs far less than remediation.

Tax Season Fraud Statistics: Why This Threat Matters

While exact figures fluctuate annually, federal agencies consistently report:

- Thousands of W-2 scams reported nationwide

- Millions of dollars in fraudulent tax returns

- Increased targeting of small and mid-sized businesses

These numbers continue rising because attackers view tax season as predictable and profitable.

What to Do If Your Business Is Targeted

If you suspect a breach:

- Contact the IRS immediately.

- Report tax fraud to the IRS using official channels.

- Notify affected employees.

- Contact your IT provider.

- Preserve evidence.

- Monitor for identity theft tax season impacts.

Quick action can limit damage.

The Broader Cybersecurity Conversation

Tax season is only one part of a larger issue: year-round cyber threats.

Small businesses in North Carolina face:

- Ransomware

- Vendor email compromise

- Credential theft

- Business email compromise

Investing in small business phishing protection isn’t seasonal — it’s strategic.

A Real-World Example

A small accounting firm in the Southeast received what appeared to be a routine W-2 request from its managing partner. The HR manager complied immediately.

Within weeks, employees began reporting rejected tax filings.

The damage:

- Over 40 employees affected

- Identity monitoring services required

- Legal fees

- Lost client trust

All from one email.

The Takeaway for North Carolina Business Owners

Small business tax scams 2026 are not theoretical. They are active.

The W-2 phishing scam remains the most immediate and damaging threat because it exploits trust and urgency.

If you operate in Raleigh, Durham, Cary, Chapel Hill, or anywhere in North Carolina, now is the time to:

- Review internal protocols

- Educate staff

- Strengthen cybersecurity controls

- Prepare incident response plans

The earlier scammers start, the earlier you must prepare.

Final Thoughts: Prevention Is Leadership

Cybersecurity is no longer just an IT issue. It is an executive responsibility.

Protecting employee tax information demonstrates:

- Operational maturity

- Regulatory compliance

- Ethical leadership

As tax season approaches, ask yourself:

If a fake executive email landed in your HR inbox today, would your team know what to do?

If the answer is uncertain, the time to act is now.

Frequently Asked Questions (FAQs)

- What is the W-2 scam targeting small businesses in 2026?

The W-2 scam small businesses face in 2026 is a form of tax season fraud in which cybercriminals impersonate company executives and request employee W-2 forms or payroll data from HR or accounting teams. Once obtained, this information is used for tax identity theft, fraudulent filings, or sold on the dark web. It remains one of the most damaging tax season scams because it targets highly sensitive employee data.

- Why are tax season scams starting earlier each year?

Cybercriminals are launching early tax scams targeting businesses because organizations now operate digitally year-round. Payroll systems, HR portals, and executive communications are primarily email-based, giving attackers more opportunities to exploit trust. By starting early, scammers aim to strike before businesses fully activate tax-season security protocols.

- How does a tax season scam work for small businesses?

A typical tax season phishing attack begins with email spoofing. The attacker impersonates a CEO or CFO and sends an urgent request to HR for employee tax documents. If the request is fulfilled without verification, payroll data is exposed. This leads to tax identity theft, fraudulent returns, and significant financial and reputational damage.

- What are the signs of a fake tax request email for businesses?

Common red flags include:

- Urgent requests for bulk employee information

- Slightly altered email domains

- Requests that bypass normal procedures

- Emails sent outside of normal business hours

- Unusual tone or grammatical errors

Being able to identify phishing during tax season is critical for preventing a payroll data breach.

- How can small businesses in North Carolina prevent W-2 phishing scams?

Effective tax scam prevention for small business includes:

- Implementing multi-factor authentication (MFA)

- Establishing mandatory verification procedures

- Training staff to detect W-2 phishing emails

- Using email spoofing prevention tools (SPF, DKIM, DMARC)

- Conducting regular cybersecurity awareness training

Proactive small business cybersecurity during tax season significantly reduces risk.

- What should we do if we fall victim to a tax season fraud attempt?

If your business suspects a breach:

- Immediately report tax fraud to the IRS.

- Notify affected employees.

- Contact your IT security provider.

- Preserve email evidence.

- Monitor for identity theft tax season consequences.

Quick response can limit financial and legal impact.

- Are small businesses more vulnerable to cybersecurity tax scams?

Yes. Small and mid-sized businesses often lack dedicated cybersecurity teams, making them more susceptible to tax scam risks for HR and payroll. Attackers deliberately target smaller organizations because they tend to have fewer layered defenses and more direct executive communication channels.

- Are IRS impersonation scams common during tax season??

IRS impersonation scams tend to increase during tax season. Attackers may use emails, phone calls, or texts to pressure victims into paying fake balances or sharing sensitive information. Businesses should verify any unexpected tax-related communication through official channels and avoid acting on threats or urgent payment demands.

Protect Your Business Before Tax Season Scams Strike

Tax season fraud is no longer a possibility — it is an active and growing threat. From Raleigh to Durham, Cary to Chapel Hill, small businesses across North Carolina are being targeted by sophisticated W-2 phishing scams and tax season fraud schemes.

The question is not whether these scams will circulate in 2026.

The question is whether your business is prepared.

At Computerbilities, we help North Carolina businesses strengthen their cybersecurity posture with:

✔ Advanced email security and spoofing protection

✔ Multi-factor authentication implementation

✔ Employee phishing awareness training

✔ Secure payroll and HR system protection

✔ Incident response planning and support

✔ Ongoing managed IT and cybersecurity monitoring

Do not wait for a payroll data breach to expose your employees’ personal information.

Schedule a Cybersecurity Assessment Today

If you are concerned about tax season scams, W-2 phishing attacks, or protecting employee tax information, our team is ready to help.

Contact Computerbilities today for a comprehensive cybersecurity review and ensure your business is protected — not just this tax season, but all year long.

Your employees trust you with their most sensitive data.

Let’s make sure it stays protected.